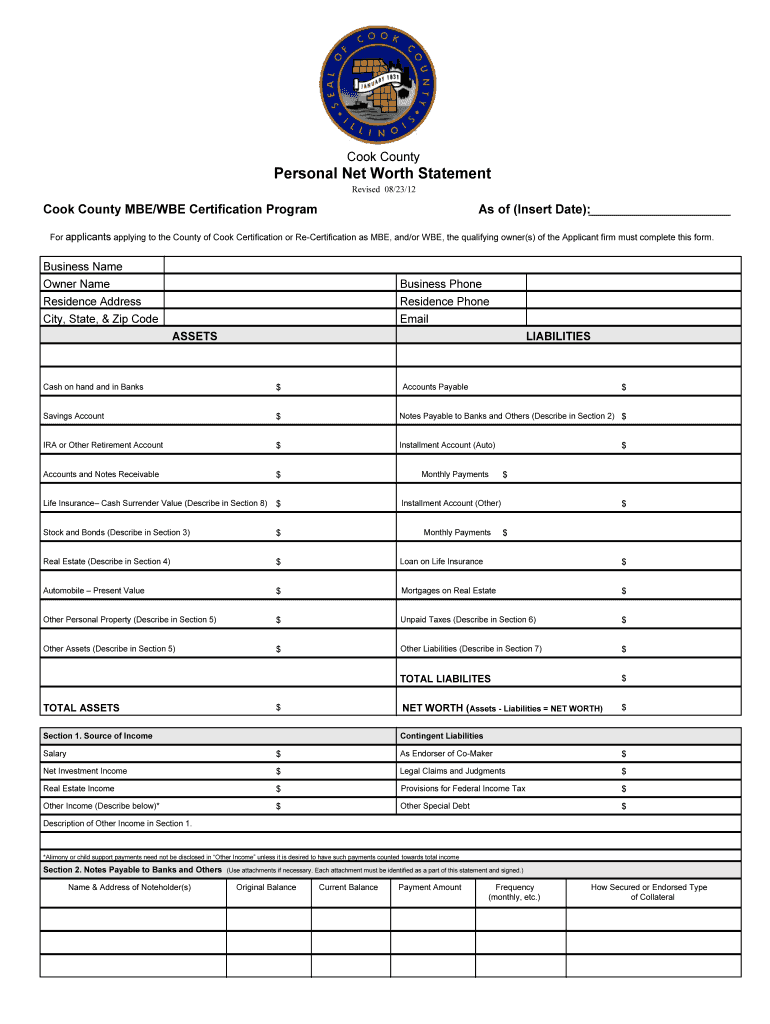

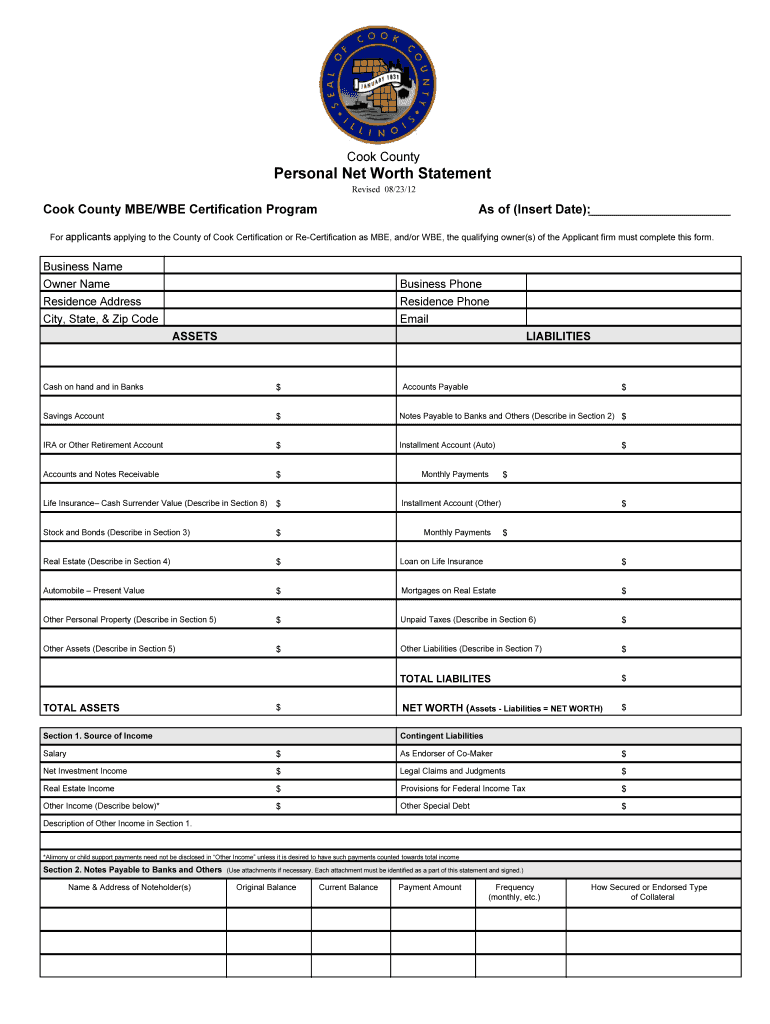

IL Personal Net Worth Statement 2012-2024 free printable template

Get, Create, Make and Sign

Editing personal net statement online

IL Personal Net Worth Statement Form Versions

How to fill out personal net statement 2012-2024

How to fill out a personal net statement:

Who needs a personal net statement:

Video instructions and help with filling out and completing personal net statement

Instructions and Help about cook personal net worth statement form

This video is going to demonstrate how to fill out a personal balance sheet or a net worth statement for the Flintstones you will find an example in Moodle under chapter 3, and it will be right here it's an Excel spreadsheet so when you click on that link and open it up your spreadsheet will look like this now first off on that worth statement is not just all the money that you have, but it's all of your belongings as well it's all of your possessions as well as all of your money, and it also is your liabilities or your debt you know how many things you owe money to and what it does is it tells businesses banks and credit card companies whether they should be issuing you credit if you're a good credit risk or not, so it's always good for you to know where you stand as well because the credit card companies and the banks will be asking you this information any time you want to take on a new loan or a credit card so what you need to know for your net worth statement is you need to know what your assets are your assets are your possessions okay, so assets equal possessions, and I am going to put that in red so you guys can see that a little better and to remind you of that, and then you will also have your liabilities and your liabilities are going to be things you all excuse me things you oh okay, so these are your possessions or things you own and liabilities are things you oh okay and if you take your assets subtract your liabilities you get your net worth, and I've got that formula down here assets minus your liabilities and that's your net worth, so we're going to figure out what the net worth is for Fred and Wilma Flintstones they come to you for help on estimating their net worth, and they provide you with the following information so calculate for them their net worth, so you have to put these where they need to be so a house is it a possession or something that you own or is it something a liability something that you oh ok now the house is something that they own ok, so that's real estate your assets can be broken down into three categories a liquid asset is going to be something that can be converted to cash quickly so if I have money in a savings account that can be converted quickly real estate is going to be houses and property and possessions I'm going to throw in here to like TVs and cars and different things like that your investment assets are going to be things like your stocks and bonds okay, so my house is going to be put into real estate it's 150 thousand dollars okay my car is also an asset car is a possession, and I'm going to put twelve thousand dollars their money in my savings account is money going to be something that can be converted quickly can I get that fast yes so my savings account will go here and that's 5,000 money in my checking account again which category would I put that in looks like it will fit into liquid assets and I have two hundred and fifty dollars in their cash again cash is obviously converting...

Fill personal net statement printable : Try Risk Free

People Also Ask about personal net statement

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your personal net statement 2012-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.